Swiggy’s upcoming IPO on Wednesday will lastly give many analysts a public comparable for what has been lengthy thought-about to be the Indian web inventory: Zomato. It’ll additionally check the nation’s urge for food for IPOs that may scale previous the $1 billion mark.

For its IPO, Swiggy has already secured $1.4 billion from institutional traders together with Norway’s sovereign wealth fund, BlackRock and eight of the top 10 Indian mutual funds. Nonetheless, it’s going to enter a public market the place massive tech corporations’ shares have struggled traditionally — three years since its $2.5 billion offering, Paytm remains to be buying and selling 47% under its IPO value.

Greater than a dozen Indian tech startups have gone public within the final 4 years, however the market has proven scant curiosity in massive IPOs. Magnificence and wellness e-commerce firm Nykaa remains to be buying and selling 53% under its debut value, and Star Well being and Alliance Insurance coverage Firm stays 48% under its IPO value three years on. Startups that raised lower than $500 million in India have carried out extremely properly, compared.

India has emerged as a hotbed for tech IPOs this 12 months even because the U.S. market stays muted. All eyes are on Swiggy’s IPO in the intervening time, notably as many growth-stage startups — and their traders — are eyeing a equally massive itemizing over the following 24 months.

Moreover, for a lot of Indian startups that have been primarily based within the U.S. and Singapore, shifting their official HQs again to India would allow them to higher adjust to native laws to do such an IPO. It’s additionally a possibility to reap the advantages of a market whose benchmark index had risen greater than 10% previously 12 months. As much as three dozen startups might be shifting their domiciles again to India within the coming years, based on traders.

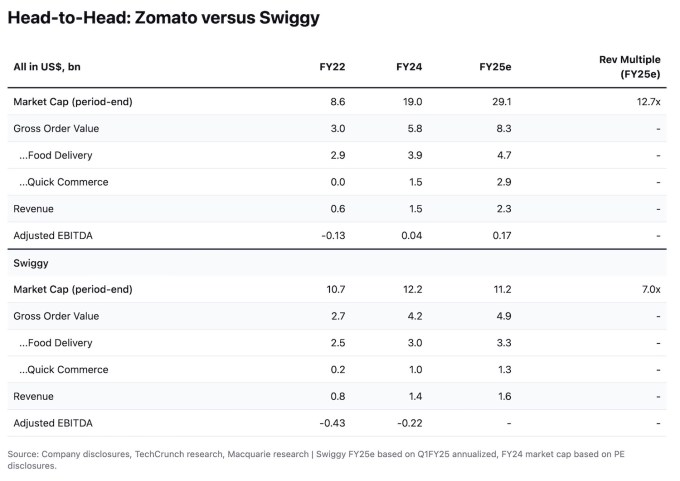

The prospects for Swiggy’s IPO appears to be like good — particularly provided that rival Zomato’s inventory has surged over 100% since its $1.3 billion itemizing in 2021, reaching a market cap excessive of $29 billion this 12 months. As compared, Swiggy is looking for a valuation of $11.3 billion.

It helps that the Indian meals supply market has lengthy been a duopoly between Zomato and Swiggy. And what makes the supply much more enticing to traders is that Swiggy is among the many dozen corporations trying to disrupt the $1.1 billion Indian retail market that’s nonetheless dominated by hundreds of thousands of mom-and-pop shops.

Swiggy’s Instamart is among the many high three quick-commerce companies within the nation, which promise deliveries of groceries, wellness and sweetness merchandise and rather more inside 10 minutes. Whether or not these corporations will be capable to revolutionize the broader retail market in India stays to be seen, however they’ve already captured 56% of the net grocery supply market from e-commerce corporations, based on JPMorgan.

Fast-commerce corporations reminiscent of Instamart, Zomato-owned BlinkIt, Zepto, BigBasket, and Minutes are altering shopper habits in city Indian cities, dwelling to about 80 million individuals. Collectively, they’re on observe to document gross sales of greater than $6 billion this 12 months, based on TechCrunch estimates.

“I don’t suppose Swiggy will simply be an e-commerce firm sooner or later, however I do suppose that given the expansion fee of Instamart, and the overall addressable promote it’s going after, the proportion of e-commerce in Swiggy goes to have a dramatic change,” stated Swiggy co-founder and chief government Sriharsha Majety (pictured above on the high) in an interview with TechCrunch.

Underpinning this enterprise mannequin is a singular provide chain system that includes strategically organising tons of of discrete warehouses, or “darkish shops,” inside kilometers of residential and enterprise areas. This permits the corporations to make deliveries inside minutes of an order.

This method differs from that of e-commerce gamers like Amazon and Flipkart, which have fewer however a lot bigger warehouses in areas the place lease is cheaper and farther from residential areas.

Swiggy operates over 600 such services, whereas Zomato’s Blinkit ended the September quarter with 791 shops.

Swiggy, which counts Prosus, SoftBank, Accel and Elevation amongst its backers, has scaled Instamart to 30 Indian cities. However many traders and analysts have expressed doubts concerning the viability of extending the quick-commerce mannequin to smaller Indian cities and cities.

“Do now we have an working mannequin for metropolis quantity 500? Actually, I don’t know,” stated Majety. Requested if the mannequin works on metropolis quantity 75, Majety stated: “I believe that most likely exists. We are going to see metropolis 75 having fast commerce.”

Swiggy’s IPO will even present how keen traders are to guess on enterprise fashions that prioritize development over income amid difficult world situations.

For Dutch investor Prosus, Swiggy’s itemizing might ship a three-fold return. It’ll even be the enterprise agency’s largest hit from India, the place its $1 billion-plus beneficial properties from Byju’s have all however evaporated. Accel is anticipated to see a greater than 35-fold return, one among its largest previously 5 years.

Trending Merchandise